Deep Dive 2025

Alberta Defence Technology Landscape

Overview

Canada’s 2025 Federal Budget signalled a decisive shift: building national security now means investing far beyond traditional defence. Ottawa is committing to modern infrastructure and the digital and industrial capacity needed to remain competitive and resilient in a rapidly changing world. The budget also expands the definition of sovereignty to include secure borders, safer communities and robust cyber and financial systems, backed by new frameworks that enable Canada to act with greater autonomy.

For Alberta’s fast-growing defence and dual-use tech ecosystem, this creates a generational opportunity to scale innovation that protects Canadians at home and strengthens our role with allies abroad.

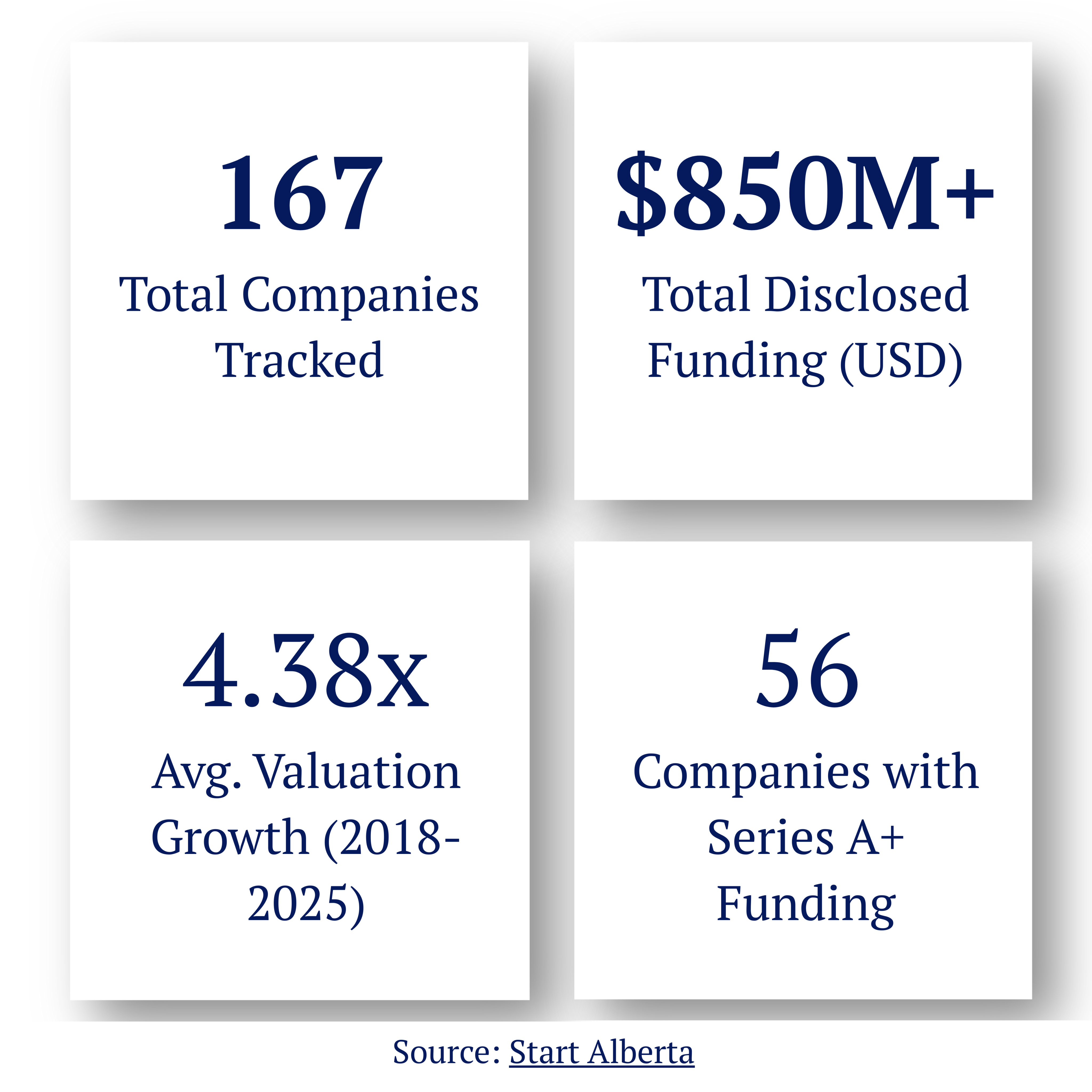

Alberta Defence Tech Key Figures

Under the Radar, Above the Noise

The defence tech investment landscape in Alberta is evolving into a more disciplined and strategic phase. In recent years, early-stage funding has surged, showing a renewed appetite for new ideas, while Series A rounds signal a strong pipeline of startups ready to scale. In contrast, late-stage investments have become more selective, stabilizing after earlier spikes — suggesting investors now prefer to bet small early and double down only on proven performers. Overall, the pattern is a barbell shift toward “seed-first, scale-later” capital — broad early experimentation paired with tighter late-stage conviction investment in companies demonstrating strong results.

The Alberta defence tech portfolio is highly concentrated around the digital and operational core of modern defence, with enterprise software and security dominating as the digital backbone. Transportation technologies extend this base into mobility and autonomy, while health tech and energy add resilience across critical systems. The pattern reveals a disciplined, infrastructure-centric strategy — one that focuses on enabling, securing, and mobilizing the digital foundations of defence.

Total defence tech funding percentage across different sectors.

Source: Start Alberta

The enterprise value picture shows that the market puts the highest value on AI and machine learning, treating them as the main driver of growth across the ecosystem. That value is then carried into real-world use through drones and UAVs, which earn strong equity because they apply AI to high-demand tasks like surveillance and rapid threat response. At the same time, cybersecurity value is most heavily focused on protecting critical infrastructure, showing that investors see the greatest strategic importance — and strongest returns — in securing the essential digital systems that keep key assets running.

Sample of Alberta defence and defence application funding rounds in 2025

|

Company |

Amount |

Date |

Round |

|---|---|---|---|

|

|

$60.5m |

July 2025 |

Series B |

|

|

$27m |

January 2025 |

Private Placement VC |

|

|

$12m |

March 2025 |

Series B |

|

|

$7.0m |

September 2025 |

Series A |

|

|

$4.2m |

August 2025 |

Growth Non Equity VC |

Source: Start Alberta

Alberta’s defence tech landscape in 2025 is moving from scattered experiments to technologies that are being built and adopted at scale. Large, strategic funding rounds point to a more mature ecosystem, where AI, sensing, and digital-twin tools are coming together to support national resilience. Overall, the trend is toward convergence: data intelligence, environmental monitoring, and operational safety are merging into a coordinated, dual-use foundation that combines industrial capability with adaptable, modern tech.

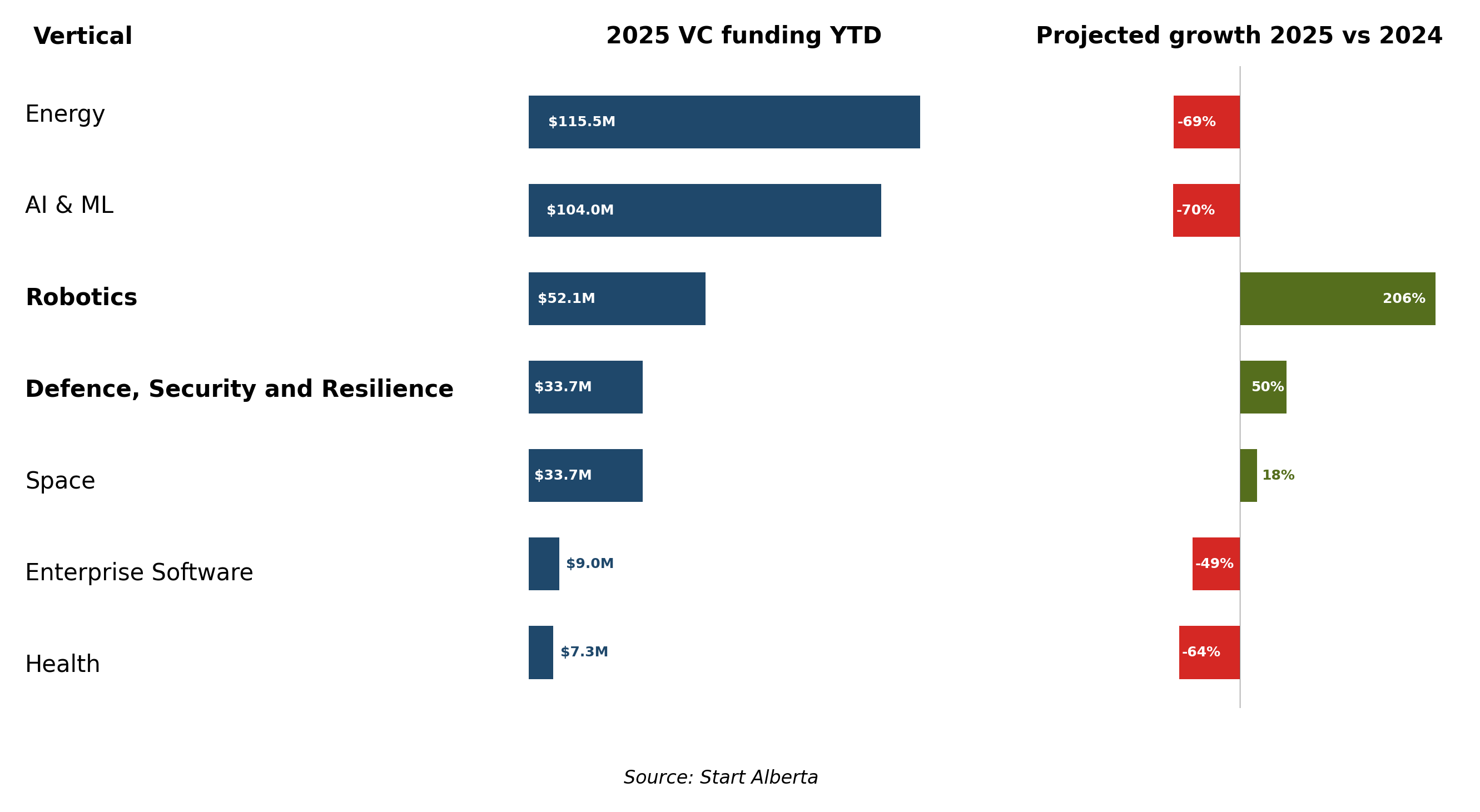

Investment in Alberta-based defence tech is undergoing a decisive rotation from general software to mission-critical hardware, evidenced by a massive 206% surge in robotics funding and nearly 50% growth. This shift highlights a strategic decoupling where investors are prioritizing physical, operational capabilities that remain resilient to broader economic downturns.

Comparison of VC funding by selected sectors

Where are Canada's defence tech startups based?

- Dominant Duopoly: Ontario (210) and Alberta (167) drive the sector, with Alberta notably hosting nearly 3x as many defence tech startups as Quebec (61) or BC (65).

- Key Hub Dynamics: Ontario thrives on a Toronto-Ottawa axis (blending finance with federal procurement), while Alberta’s activity is heavily concentrated in Calgary (commercial HQ) supported by Edmonton as a key secondary hub.

- Geographic Concentration: The ecosystem is highly centralized; the Atlantic region (14) and Territories (0) show minimal activity compared to other economic corridors.

Canadian Defence Tech Investors (2024–2025)

Between 2024 and 2025, the Canadian startup ecosystem demonstrated clear maturation — marked by increased round sizes, consistent government participation, and the growing presence of international venture capital firms.

|

Investors |

Last Round Amount |

Round Type |

|

Accel |

$120M |

Series C |

|

BDC Capital |

$22M |

Series B |

|

Brightspark Ventures |

$19M |

Series A |

|

Export Development Canada |

$17.4M |

Series B |

|

Accenture Ventures |

$15.9M |

Series B |

|

Round13 Capital |

$14M |

Series A |

|

BDC Capital |

$12.2M |

Series A |

|

Global Brain Corporation Mitsubishi Corporation Tech Ventures |

$11.5M |

Series A |

|

Axel Johnson Capital Partners |

$11.3M |

Series A |

|

White Star Capital |

$10.1M |

Series B |

An overview of major funding rounds led by institutional, venture, and public investors in 2024–2025. The dataset captures round amounts, stages, and investor networks, revealing patterns in capital concentration, co-investment behaviour, and the shift from early-stage seed investments toward larger Series A–C growth rounds. Source: Start Alberta and Dealroom

Featured Company: Blackline Safety

Blackline Safety’s real story is not gas detection but infrastructure — where their devices function as sensing nodes, their cloud platform serves as the network brain, and their analytics transform entire environments into intelligent, safety-aware ecosystems.

With acquisitions (Visijax → human interface, Swiftlabs → device and robotic engineering), Blackline has positioned itself as a command-and-sense layer between workers, environments, and emergency response operations.

Blackline’s funding history shows a capital-efficient scale strategy, raising $160.1M across IPO equity, private placements, and post-IPO debt while growing revenues from $54M (2021) to $127M (2024) and doubling EV from $225M (2023) to $492M (2024) — a rare trajectory for a hardware-plus-cloud industrial IoT platform. The company assembles a dual-use safety infrastructure platform.

- 2025 Start Alberta Tech Awards - Anchor of the Year

- Expands global footprint with new offices in Germany and UAE (A+A Düsseldorf, ADIPEC Abu Dhabi)

- 2025 Firehouse Innovation Awards — EXO 8 area gas monitor

- Record Q3 FY2025 results — $37.6M revenue, 34th straight YoY growth quarter

"Connected safety is the concept of leveraging interconnected technology and digital transformation to protect workers while on the worksite…[it] uses wearable cellular or satellite connected devices, cloud-hosted software, data and analytics and location technology to provide full situational awareness and connect workers to each other, their supervisors and emergency response personnel."

Cody Slater

CEO, Blackline Safety

Feature Company: Wyvern

Wyvern has rapidly evolved from a University of Alberta spinout into one of Canada’s fastest-advancing Earth-observation startups, nearly doubling revenue from $2.4M (2022) to $4.7M (2023) while raising $17.6M from investors including Y Combinator — evidence of accelerating demand for its high-resolution hyperspectral imaging. This funding momentum, paired with 96% annual revenue growth, signals a company transitioning from experimental missions to scalable satellite operations with clear commercial and dual-use intelligence applications.

- Feb 2025 — Wyvern launches its Open Data Program, releasing the highest-resolution commercial hyperspectral imagery to the public under CC BY 4.0.

- May 2025 — Wyvern releases 25 additional hyperspectral scenes, expanding the public catalog to 75 images ahead of GEOINT 2025.

- 2024–2025 — Noted by analysts and media for being one of the only startups delivering operational hyperspectral products rather than simulations.

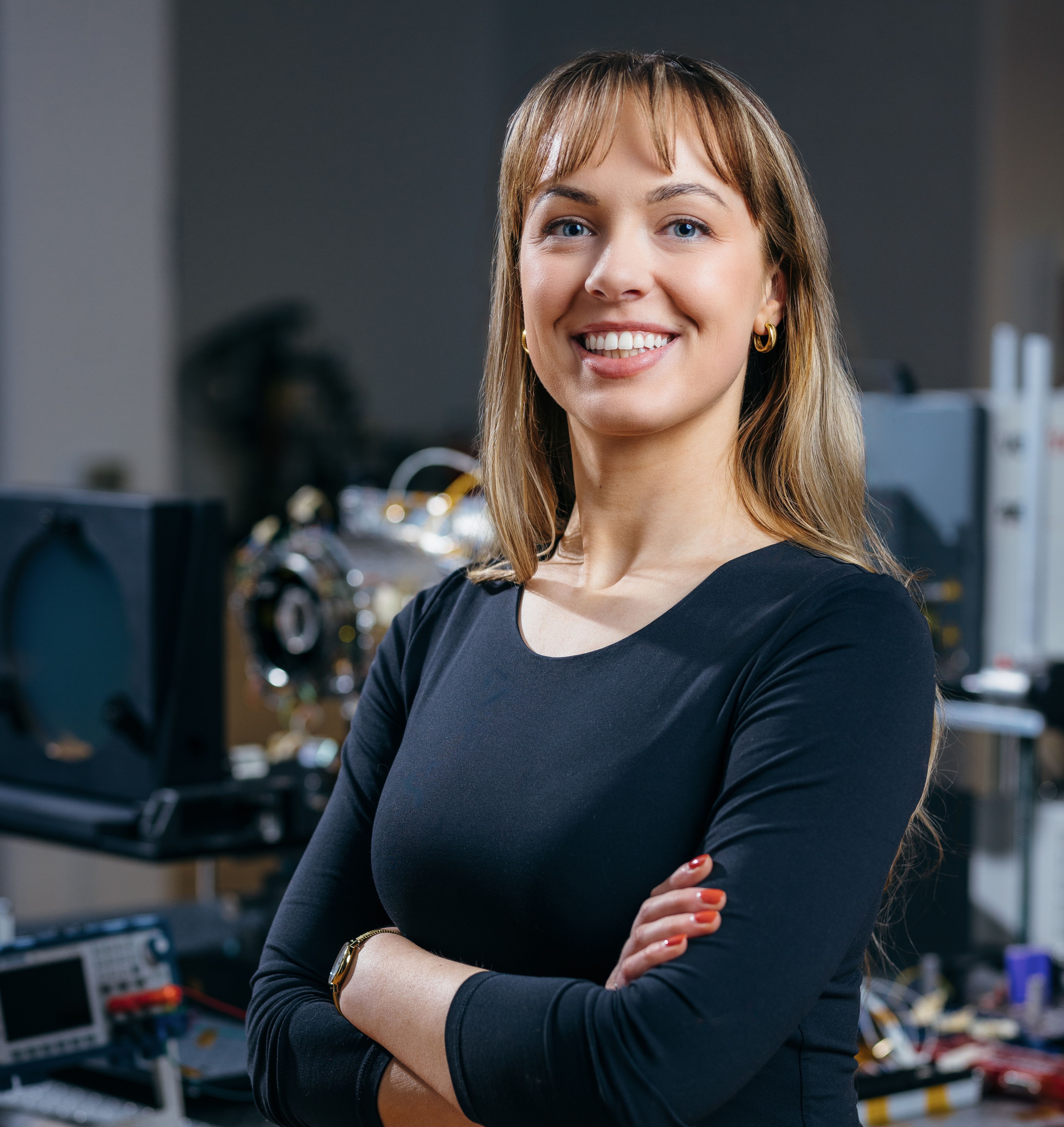

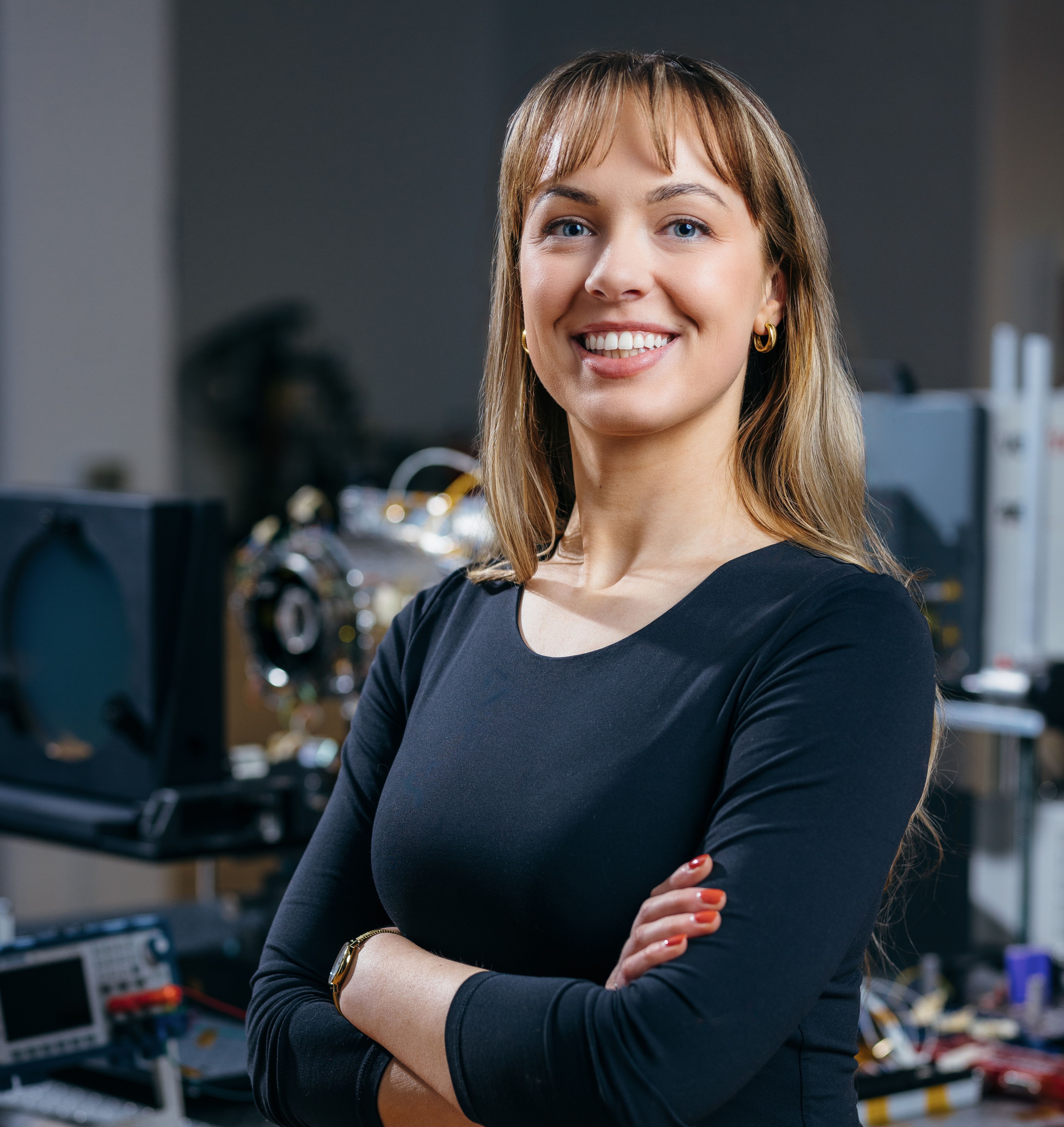

"As a first mover in both commercial hyperspectral and deployable optics technology, our role is really about pushing the boundaries of what’s possible. We are leading a lot of customer education and testing to help prove out use cases and scenarios where this data will yield tangible advantages. So not only do we need to push the way forward, but we also need to bring everyone else with us on the journey"

Callie Lissinna

Co-Founder and VP Strategic Relations

Our Methodology

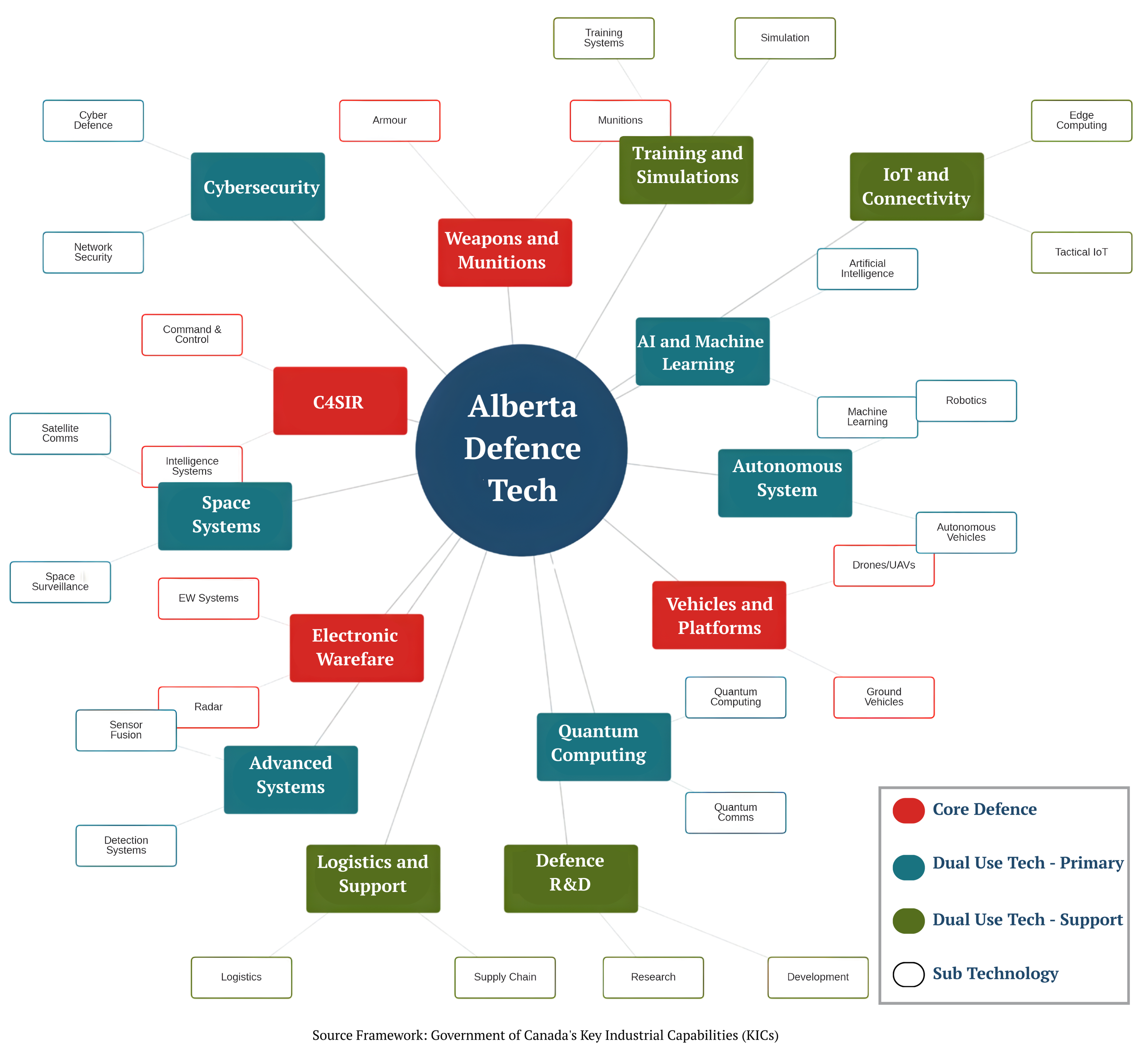

November 27, 2025 — Our Alberta Defence Tech dataset identifies, scores, and ranks Alberta-based companies with direct relevance to national defence and dual-use technologies. We utilize a reproducible, multi-stage process designed to filter noise and highlight entities contributing to critical industrial capabilities.

We aggregate data from primary public and verified sources to build a comprehensive view of the ecosystem.

- Primary Dataset: Aggregated from Start Alberta, ensuring coverage of the provincial innovation landscape.

- Reference Framework: We align our relevance criteria with the Government of Canada's Key Industrial Capabilities (KICs) to ensure national strategic alignment.

- Searchable Metadata: Our analysis scans multiple data points including company tags, industries, sub-industries, technology lists, and descriptive metadata.

Validation & Filtering Process

Automated scoring is only the first step. We apply rigorous filters to ensure data quality:

- Activity Check: Companies marked as "closed," "low activity," or "inactive" are automatically removed from the dataset.

- Manual Verification: Every shortlisted company undergoes a manual website review to confirm: operational status, explicit references to defence-relevant products or services (e.g., specific mentions of sensors, munitions, or military AI applications).

Scoring Taxonomy

To quantify relevance, we developed a weighted scoring dictionary that categorizes companies into three tiers based on their technology focus.

|

Relevance Tier |

Weight |

Definition |

Examples |

|

Core Defence |

5 Points |

Technologies explicitly designed for military application. |

Armour, Munitions, C4ISR, EW, Weapons Systems |

|

Dual-Use (Primary) |

3 Points |

Commercial technologies with high-value defence applications. |

AI, Robotics, Autonomous Systems, Space Systems, Cyber |

|

Support/Contextual |

1 Point |

Enabling technologies that support the defence supply chain. |

Industrial IoT, Logistics, Training & Simulation, Digital Twins |

Definitions and Ranking

How we interpret the data for this report:

- High Relevance (Score 10+): Companies with a strong focus on core defence technologies.

- Medium Relevance (Score 4-9): Firms primarily focused on dual-use technologies like AI or sensors that have defence applications.

- Support Relevance (Score 1-3): Companies providing logistical or training support to the sector.

Tie-Breaking: When companies have identical total scores, priority is given to those with a higher count of "Core Defence" (5-point) keywords.

About Start Alberta

Initiated by Alberta Enterprise Corporation (AEC), A100 and the Venture Capital Association of Alberta (VCAA) and in collaboration with a wide group of community partners, Start Alberta provides real-time data for founders, investors, corporates and government stakeholders, cataloguing the collective regional tech ecosystem.

Operated by the A100 since 2021, Start Alberta is the most comprehensive database on startups and funding in the province, providing insights on the health of the regional innovation economy while showcasing the Alberta startup ecosystem to the world.

|

|

|

|

|---|